Trap for the Unwary (Married Couples Only—But Also Important for Single Individuals)

Many people only think about a “step-up” in basis when assets are inherited. (“Basis,” simply put, is the price you paid for an asset like…

Many people only think about a “step-up” in basis when assets are inherited. (“Basis,” simply put, is the price you paid for an asset like…

Let's talk about something we all love to avoid: planning for the future, especially the not-so-fun parts. You know, like what happens if you're not…

We are more and more a password-protected world. We are more and more a paperless society. This combination is causing unexpected heartache and frustration. Read…

For over 46 years as I have watched from the sidelines helping clients with estate planning and then probate and trust administration after they lose a…

Although the challenges in our lives seem to be headed our way with increasing speed, the blessings that we are given far exceed the challenges…

Recent estate law changes have created new opportunities for people with less than $10 million in assets to reduce future income taxes for their beneficiaries.…

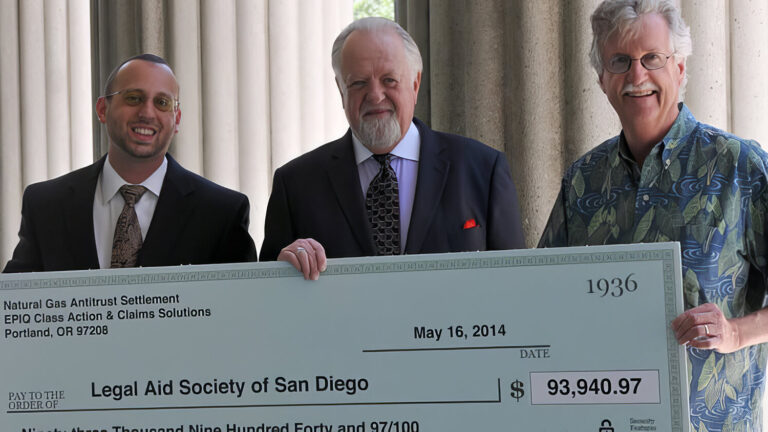

On Friday, May 16, 2014, Brad Baker, partner at the Law Offices of Baker, Burton & Lundy, presented a donation of $93,940 from the Anti-trust…