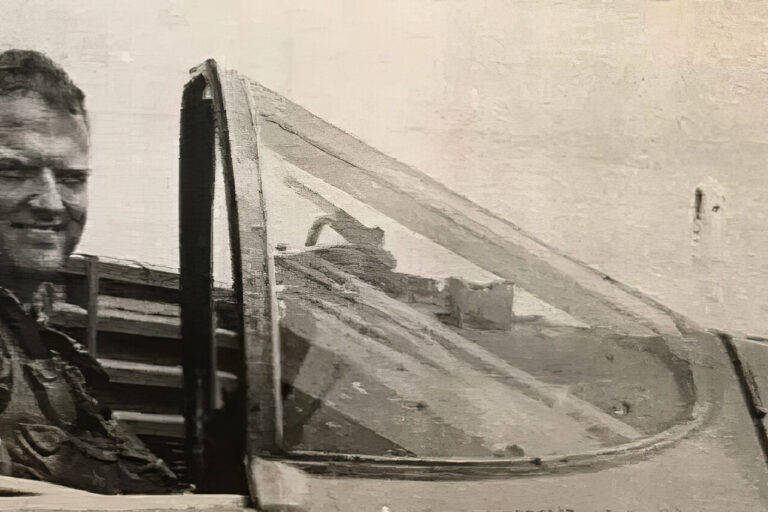

Memorial Day Tribute to Major Albro Lynn Lundy Jr.

A fellow pilot shares a Memorial Day Tribute to Major Albro L. Lundy Jr., one of many fallen heroes who gave the ultimate sacrifice for…

A fellow pilot shares a Memorial Day Tribute to Major Albro L. Lundy Jr., one of many fallen heroes who gave the ultimate sacrifice for…